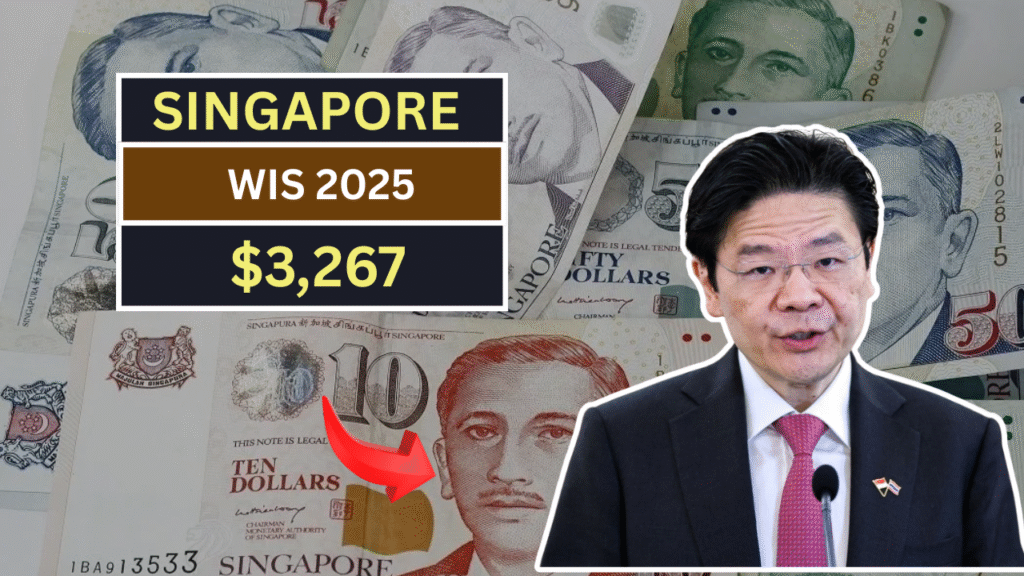

Starting January 2025, thousands of lower-income platform workers including delivery riders and ride-hailing drivers will receive significant financial support as part of the government’s Enhanced Workfare Income Supplement (WIS) and CPF Transition Support (PCTS) schemes. This new initiative ensures that as these workers begin contributing more to their Central Provident Fund (CPF), they won’t suffer a drop in take-home pay.

The enhancements come amid a broader policy shift to align the CPF contribution rates of platform workers with those of traditional employees by 2029, strengthening their long-term financial security.

Full CPF Support in 2025

Under the Platform Workers CPF Transition Support (PCTS) scheme, the government will fully offset increases in CPF contributions for eligible platform workers in 2025. This means workers will not see any reduction in their take-home pay during the first year of the transition.

The cash support will taper off gradually:

- 75% offset in 2026

- 50% offset in 2027

- 25% offset in 2028

By 2029, platform workers are expected to contribute the full CPF employee rate, aligned with all other workers in Singapore.

Summary: What Workers Need to Know

| Feature | Details |

|---|---|

| CPF Increase Support | 100% offset in 2025, then tapers to 25% by 2028 |

| Income Cap | $3,000/month net income |

| Eligibility | Singapore citizens, born in or after 1995 (or opted-in), CPF increase over previous year |

| Payout Method | PayNow (NRIC-linked), bank transfer, or GovCash |

| WIS Payment | Monthly from March 2025 |

| Application Needed? | No – assessments are automatic |

Increased Income Threshold

The income cap for eligibility has also been revised. Previously set at $2,500 per month, the new monthly net income ceiling has been raised to $3,000 (after fixed expenses). This expansion allows more workers to qualify for the scheme.

To be eligible for the PCTS, platform workers must:

- Be Singapore citizens

- Be born in 1995 or later, or voluntarily opt-in if born earlier

- Earn $3,000 or less per month (after expense deductions)

- See an increase in CPF contributions compared to the previous year

Simple, Automatic Support Payments

There is no need to apply for the monthly payouts. Eligible workers will be automatically assessed based on income data provided by platform operators.

Monthly cash support will be paid via PayNow (linked to NRIC), or if unavailable, through registered bank accounts or GovCash.

For example, a 32-year-old platform worker earning $2,000 monthly (after expenses) will see his CPF contributions rise by $50 in 2025. He will receive a $50 cash payout monthly to fully cover this increase. In 2026, with a 75% offset, his payout will reduce to $38.

Payments will be made with a two-month lag for example, income earned in January 2025 will be paid in March 2025.

Enhanced Workfare Income Supplement (WIS) Scheme

Complementing the CPF support is a revamped Workfare Income Supplement (WIS) scheme. As of March 2025, eligible platform workers will receive monthly WIS payouts instead of the previous annual disbursement. This change helps smooth income flows and provides faster support.

The WIS payout comprises both cash and CPF savings, boosting short- and long-term financial wellbeing.

From 2029 onwards, platform workers contributing CPF at full employee rates will receive the same enhanced WIS benefits as traditional employees 40% in cash and 60% credited to their CPF accounts.

A Gradual, Supportive Transition

The Ministry of Manpower (MOM) and the CPF Board emphasized that these enhancements aim to minimise disruption for workers while achieving CPF parity.

“This structured, gradual approach helps platform workers build stronger retirement savings while cushioning any immediate financial impact,” MOM stated in a press release.

CPF contributions for platform workers have long lagged behind salaried employees, leaving many without adequate retirement savings or housing funds. The changes seek to address this disparity while recognizing the unique challenges gig workers face.

Broader Legislative Reforms

These financial measures come on the heels of the Platform Workers Bill, passed to legally require platform companies to make CPF contributions for workers under 30. Starting in 2025, platform operators must match employee CPF rates gradually, ensuring shared responsibility for workers’ welfare.

Conclusion

Singapore’s Enhanced WIS 2025 and CPF Transition Support schemes mark a pivotal step in strengthening the social safety net for platform workers. By cushioning the impact of higher CPF contributions and providing more timely financial aid, the government is not only safeguarding workers’ immediate incomes but also investing in their long-term financial security.